|

The Two Big Issues the Housing Market’s Facing Right Now

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply: “Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.” Let’s break down these two big issues in today’s housing market. Rate-Locked HomeownersAccording to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below): But today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked. When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens. The Fear of Not Finding Something To BuyThe other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options. That includes newly built homes, especially right now when builders are offering concessions like mortgage rate buydowns. What Does This Mean for You?These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market is a sweet spot that can work to your advantage. Be sure to work with a local real estate professional to explore the options you have right now, which could include leveraging your current home equity. According to ATTOM: “. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.” This could make a major difference when you move. Work with a local real estate expert to learn how putting your equity to work can keep the cost of your next home down. Bottom LineRate-locked homeowners and the fear of not finding something to buy are keeping housing inventory low across the country. But as mortgage rates start to come down this year and homeowners explore all their options, we should expect more homes to come to the market. A Smaller Home Could Be Your Best Option

Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says: “As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes.” Lautz lists two options: move into a multigenerational home with loved ones, or stay in your current house. Multigenerational living is rising in popularity, but it isn’t an option for everyone. And staying put may fit fewer and fewer of your needs. There’s a third option though, and for some, it’s the best one: downsizing. When you sell your house and purchase a smaller one, it’s known as downsizing. Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location. In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares: “Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.” Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference. A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home. So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. Your local real estate advisor is the best resource to help you understand how much equity you may have in your current home and what options it can provide for your next move. Bottom LineIf you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Let’s connect so you can understand your options and explore your downsizing opportunities. How To Make Your Dream of Homeownership a Reality

According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable. However, it’s unlikely all 28 million Americans will accomplish that goal in the coming year. Experts project a total of around five million homes will be sold in 2023. Why is there such a big difference? It’s partly because there can be challenges to buying a home. In the same survey, when asked, “Which of the following are preventing you from pursuing homeownership at this time?”:

Save for Your Down PaymentYour down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front (a down payment) and then take out a loan (a mortgage) to pay for the rest. It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. In fact, according to the National Association of Realtors (NAR), today’s median down payment is 14% for the average buyer and just 6% for a first-time buyer. Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Plus, there are even loan types, like FHA loans, with down payments as low as 3.5% for some buyers, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment:

Improve Your Credit ScoreYour credit score is a number that indicates how financially reliable you are to lenders. A higher credit score usually means you’ll be able to borrow more money at a better interest rate. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it. Here are two:

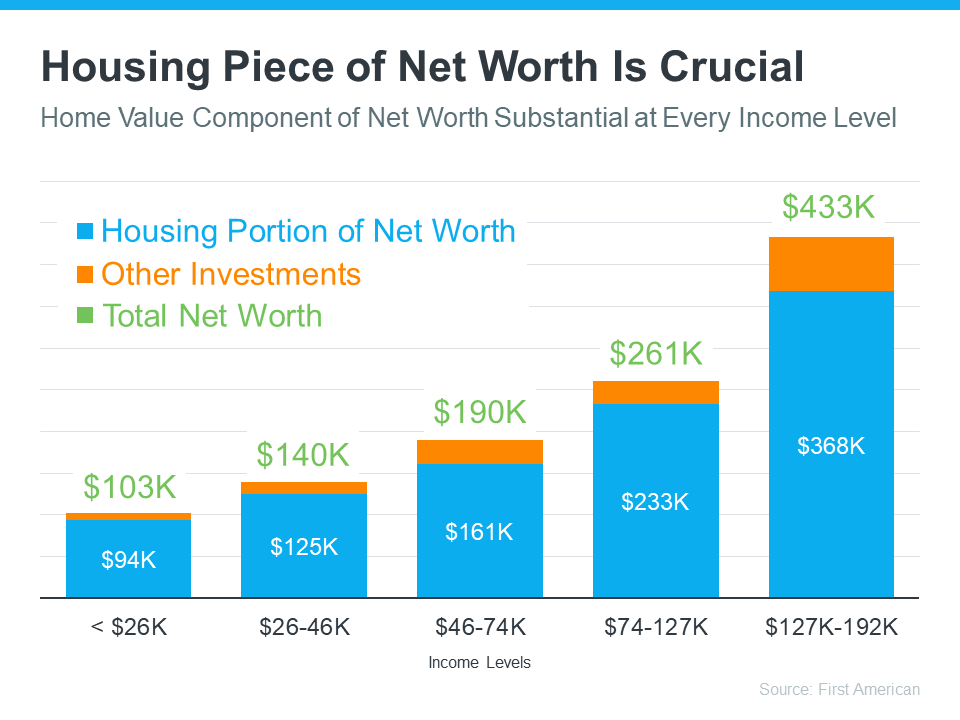

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac: “Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.” With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional. The Largest Part of Most Homeowners’ Net Worth Is Their Equity You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares: “Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.” In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below): Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect today so you can start investing in homeownership. An Expert Makes All the Difference When You Sell Your House

If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale. 1. They’re Experts on Market TrendsWith today’s housing market defined by change, it’s critical to work with someone who knows the latest information and how it impacts your goals. An expert real estate advisor knows about national trends and your local area too. More importantly, they’ll give insight to what all of this means for you, so they’ll be able to help you make a decision based on trustworthy, data-bound information. 2. A Local Professional Knows How To Set the Right Price for Your HomeHome price appreciation has moderated this year. If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. Pricing your house too high can deter buyers or cause your house to sit on the market for longer. Real estate professionals look at a variety of factors, like the condition of your home and any upgrades you’ve made, with an unbiased eye. They compare your house to recently sold homes in your area to find the best price for today’s market so your house sells quickly. 3. A Real Estate Advisor Helps Maximize Your Pool of BuyersSince buyer demand has cooled this year, you’ll want to do what you can to help bring in more buyers. Real estate professionals have a wide range of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS), to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides: “You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.” Without access to your agent’s tools and marketing expertise, your buyer pool – and your home’s selling potential – is limited. 4. A Real Estate Expert Will Read – and Understand – the Fine PrintToday, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) puts it like this: “There’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.” 5. A Local Professional Is a Skilled NegotiatorIn today’s market, buyers are regaining some negotiation power. If you sell without an expert, you’ll be responsible for any back-and-forth. That means you’ll have to coordinate with:

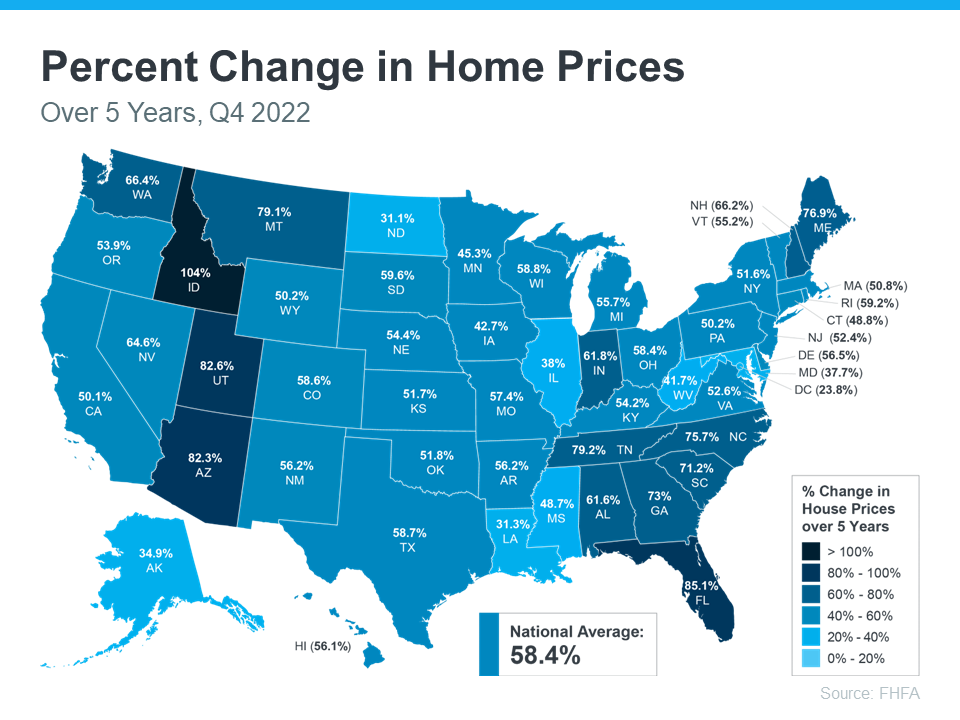

Bottom LineDon’t go at it alone. If you’re planning to sell your house this spring, let’s connect so you have an expert by your side to guide you in today’s market.  Equity Gains for Today’s Homeowners Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates. How Equity Has Grown in Recent Years Because of the imbalance between how many homes were for sale and the number of homebuyers in the market over the past few years, home prices appreciated substantially. And while price appreciation has slowed this year, that doesn’t mean you’ve lost all the equity in your home. In fact, the latest Homeowner Equity Insights report from CoreLogic finds the average homeowner’s equity has grown by $34,300 over the past year alone. And if you’ve been in your home longer than that, chances are you have even more equity than you realize. While that’s the national number, if you want to know what happened in your area, look at the map below from the Federal Housing Finance Agency (FHFA). It shows on average how much home prices have risen over the past five years, which has been a major driver behind equity growth. Why This Is So Important Right Now

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you’ve built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling, it may be time to find out how much equity you have and how it can help fuel your next move. Bottom LineHomeownership is a long game, and if you’re planning to make a move, the equity you’ve gained over time can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect. |

Let's ConnectWith the correct person by your side, the buying and selling process doesn't have to be full of stress, doubt and anxiety - it can actually be FUN! Archives

July 2024

Categories

All

Jacquelyn Duke, Realtor®

Licensed to Sell in the State of Iowa [email protected] (515) 240-7483 Realty One Group Impact 617 SW 3rd Street Ste 101 Ankeny, IA 50023 Disclaimer: The material on this site is solely for informational purposes. No warranties or representations have been made. |

RSS Feed

RSS Feed