|

A Window of Opportunity for Homebuyers

Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range of pre-pandemic levels for buyer demand and home sales. But the transition back toward pre-pandemic levels isn’t a bad thing. In fact, the years leading up to the pandemic were some of the best the housing market has seen. That’s why, as the market undergoes this shift, it’s important to compare today not to the abnormal pandemic years, but to the most recent normal years to show how the current housing market is still strong. Higher Mortgage Rates Are Moderating the Housing Market The ShowingTime Showing Index tracks the traffic of home showings according to agents and brokers. It’s also a good indication of buyer demand over time. Here’s a look at their data going back to 2017 (see graph below): Here’s a breakdown of the story this data tells:

Higher Mortgage Rates Slow the Once Frenzied Pace of Home SalesAs mortgage rates started to rise this year, other shifts began to occur too. One additional example is the slowing pace of home sales. Using data from the National Association of Realtors (NAR), here’s a look at existing home sales going all the way back to 2017. Much like the previous graph, a similar trend emerges (see graph below): Again, the data paints a picture of the shift:

So don’t let the headlines about the market cooling or moderating scare you. The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic – and that’s a good thing. It opens up new opportunities for you to find a home that meets your needs. Bottom LineThe housing market is undergoing a shift because of higher mortgage rates, but the market is still strong. If you’ve been looking to buy a home over the last couple of years and it felt impossible to do, now may be your opportunity. Buying a home right now isn’t easy, but there is more opportunity for those who are looking.

0 Comments

A Real Estate Professional Helps You Separate Fact from Fiction

If you’re following the news, chances are you’ve seen or heard some headlines about the housing market that don’t give the full picture. The real estate market is shifting, and when that happens, it can be hard to separate fact from fiction. That’s where a trusted real estate professional comes in. They can help debunk the headlines so you can really understand today’s market and what it means for you. Here are three common housing market myths you might be hearing, along with the expert analysis that provides better context. Myth 1: Home Prices Are Going To FallOne piece of fiction many buyers may have seen or heard is that home prices are going to crash. That’s because headlines often use similar, but different, terms to describe what’s happening with prices. A few you might be seeing right now include:

“. . . higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.” Myth 2: The Housing Market Is in a CorrectionAnother common myth is that the housing market is in a correction. Again, that’s not the case. Here’s why. According to Forbes: “A correction is a sustained decline in the value of a market index or the price of an individual asset. A correction is generally agreed to be a 10% to 20% drop in value from a recent peak.” As mentioned above, home prices are still appreciating, and experts project that will continue, just at a slower pace. That means the housing market isn’t in a correction because prices aren’t falling. It’s just moderating compared to the last two years, which were record-breaking in nearly every way. Myth 3: The Housing Market Is Going To CrashSome headlines are generating worry that the housing market is a bubble ready to burst. But experts say today is nothing like 2008. One of the reasons why is because lending standards are very different today. Logan Mohtashami, Lead Analyst for HousingWire, explains: “As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. This typically happens in a recession, however, the notion that credit lending in America will collapse as it did from 2005 to 2008 couldn’t be more incorrect, as we haven’t had a credit boom in the period between 2008-2022.” During the last housing bubble, it was much easier to get a mortgage than it is today. Since then, lending standards have tightened significantly, and purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Bottom LineNo matter what you’re hearing about the housing market, let’s connect. That way, you’ll have a knowledgeable authority on your side that knows the ins and outs of the market, including current trends, historical context, and so much more. Why Are People Moving Today?

Buying a home is a major life decision. That’s true whether you’re purchasing for the first time or selling your house to fuel a move. And if you’re planning to buy a home, you might be hearing about today’s shifting market and wondering what it means for you. While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors. Instead, it’s necessary to consider why you want to move and how important those reasons are to you. Here are two of the biggest personal motivators driving people to buy homes today. A Need for More SpaceMoving.com looked at migration patterns to determine why people moved to specific areas. One trend that emerged was the need for additional space, both indoors and outdoors. Outgrowing your home isn’t new. If you’re craving a large yard, more entertaining room, or just need more storage areas or bedrooms overall, having the physical space you need for your desired lifestyle may be reason enough to make a change. A Desire To Be Closer to Loved OnesMoving and storage company United Van Lines surveys customers each year to get a better sense of why people move. The latest survey finds nearly 32% of people moved to be closer to loved ones. Another moving and storage company, Pods, also highlights this as a top motivator for why people move. They note that an increase in flexible work options has helped many homeowners make a move closer to the people they care about most: “. . . a shifting of priorities has also affected why people are moving. Many companies have moved to permanent remote working policies, giving employees the option to move freely around the country, and people are taking advantage of the perk.” If you can move to another location because of remote work, retirement, or for any other reason, you could leverage that flexibility to be closer to the most important people in your life. Being nearby for caregiving and being able to attend get-togethers and life milestones could be exactly what you’re looking for. What Does That Mean for You?If you’re thinking about moving, one of these reasons might be a top motivator for you. And while what’s happening with mortgage rates and home prices in the housing market today will likely play a role in your decision, it’s equally important to make sure your home meets your needs. Like Charlie Bilello, Founder and CEO of Compound Capital Advisors, says: “Your home is your castle and should confer benefits beyond just the numbers.” Bottom LineThere are many reasons why people decide to move. No matter what the reason may be, if your needs have changed, let’s connect to discuss your options in today’s housing market. Buying a Home May Make More Financial Sense Than Renting One

If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says: “The median rent across the 50 largest US metropolitan areas reached $1,876 in June, a new record level for Realtor.com data for the 16th consecutive month.” That means rising prices will likely impact your housing plans either way. But there are a few key differences that could make buying a home a more worthwhile option for you. If You Need More Space, Buying a Home May Be More AffordableWhat you may not realize is that, according to the latest data from realtor.com and the National Association of Realtors (NAR), it may actually be more affordable to buy than rent depending on how many bedrooms you need. The graph below uses the median rental payment and median mortgage payment across the country to show why. As the graph conveys, if you need two or more bedrooms, it may actually be more affordable to buy a home even as prices rise. While this doesn’t take into consideration the interest deduction or other financial advantages that come with owning a home, it does help paint the picture that it may be more affordable to buy then rent for that unit size based on nationwide averages. So, if one of the factors motivating you to move is a desire for more space, this could be the added encouragement you need to consider homeownership. Homeownership Also Provides Stability and a Chance To Grow Your WealthIn addition to being more affordable depending on how many bedrooms you need, buying has two other key benefits: payment stability and equity. When you buy a home, you lock in your monthly payment with your fixed-rate mortgage. And that’s especially important in today’s inflationary economy. With inflation, prices rise across the board for things like gas, groceries, and more. Locking in your housing payment, which is likely your largest monthly expense, can provide greater long-term stability and help shield you from those rising expenses moving forward. Renting doesn’t provide that same predictability. A recent article from CNET explains it like this: “...if you buy a house and secure a fixed-rate mortgage, that means that no matter how much prices or interest rates go up, your fixed payment will stay the same every month. That's an advantage over renting since there's a good chance your landlord will raise your rent to counter inflationary pressures.” Not to mention, when you buy, you have the chance to build equity, which in turn grows your net worth. It works like this. As you pay down your home loan over time and as home values continue to appreciate, so does your equity. And that equity can make it easier to fuel a move into a future home if you decide you need a bigger home later on. Again, the CNET article mentioned above helps explain: “Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home that you can tap into later on. When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.” Bottom LineIf you’re trying to decide whether to keep renting or buy a home, let’s connect to explore your options. With home equity and a shield against inflation on the line, it may make more sense to buy a home if you’re able to. Why It’s Still a Sellers’ Market

As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal. Even though the supply of homes for sale has been growing this year, there’s still a shortage of homes on the market. And that means conditions continue to favor sellers today. That’s because the level of inventory of homes for sale can help determine if buyers or sellers are in the driver’s seat. Think of it like this:

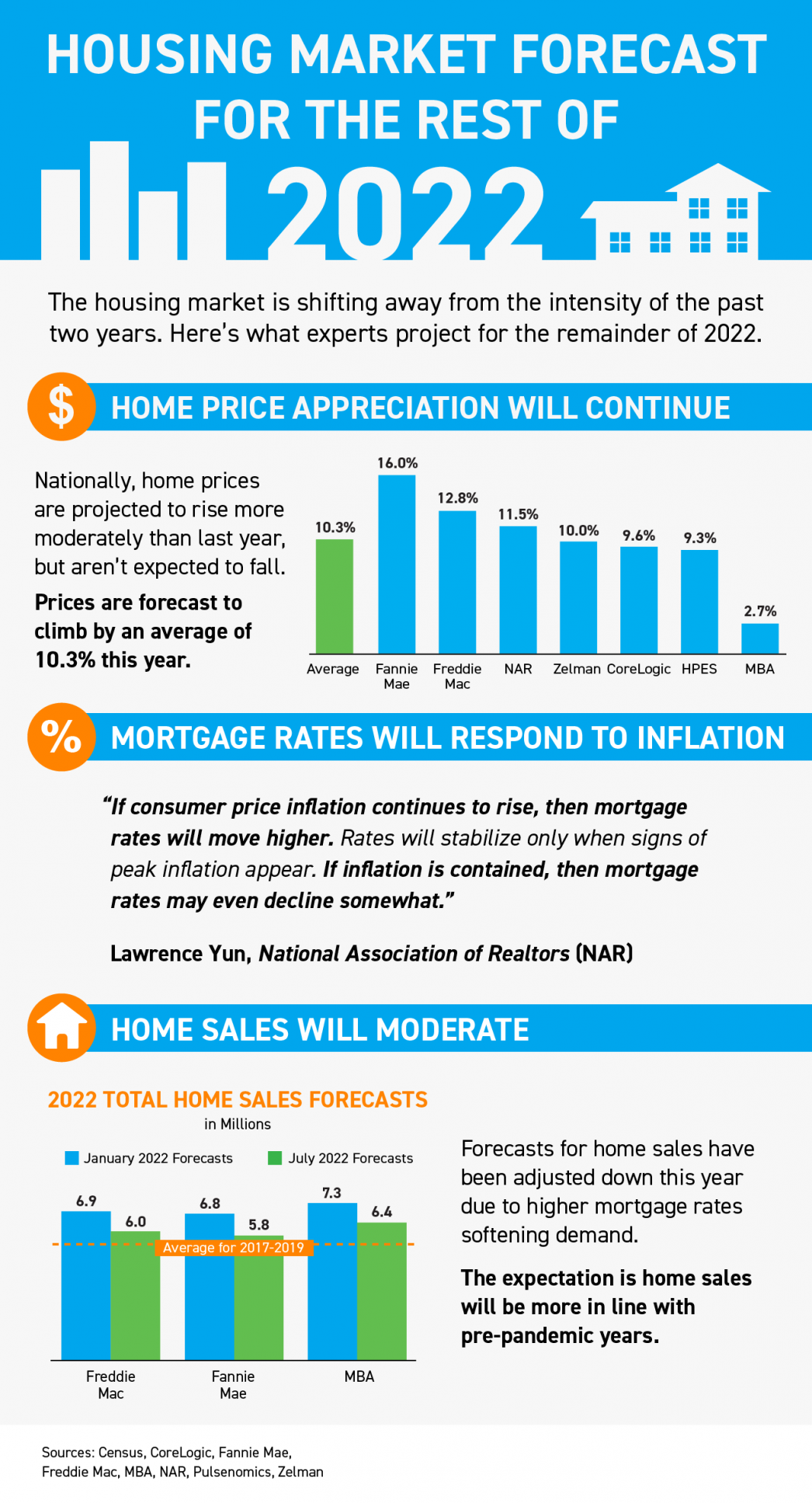

What Does This Mean for You? Ed Pinto, Director of the American Enterprise Institute’s Housing Center, gives a perfect summary of what’s happening in today’s market, saying: “Overall, the best summary is that we'll move from a gangbuster sellers' market to a modest sellers' market.” Conditions are still in your favor even though the market is cooling. If you work with an agent to price your house at market value, you’ll find success when you sell your house today. While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed. Bottom LineToday’s housing market still favors sellers. If you’re ready to sell your house, let’s connect so you can start making your moves. Housing Market Forecast for the Rest of 2022 [INFOGRAPHIC]

Some Highlights

|

Let's ConnectWith the correct person by your side, the buying and selling process doesn't have to be full of stress, doubt and anxiety - it can actually be FUN! Archives

July 2024

Categories

All

Jacquelyn Duke, Realtor®

Licensed to Sell in the State of Iowa [email protected] (515) 240-7483 Realty One Group Impact 617 SW 3rd Street Ste 101 Ankeny, IA 50023 Disclaimer: The material on this site is solely for informational purposes. No warranties or representations have been made. |

RSS Feed

RSS Feed