|

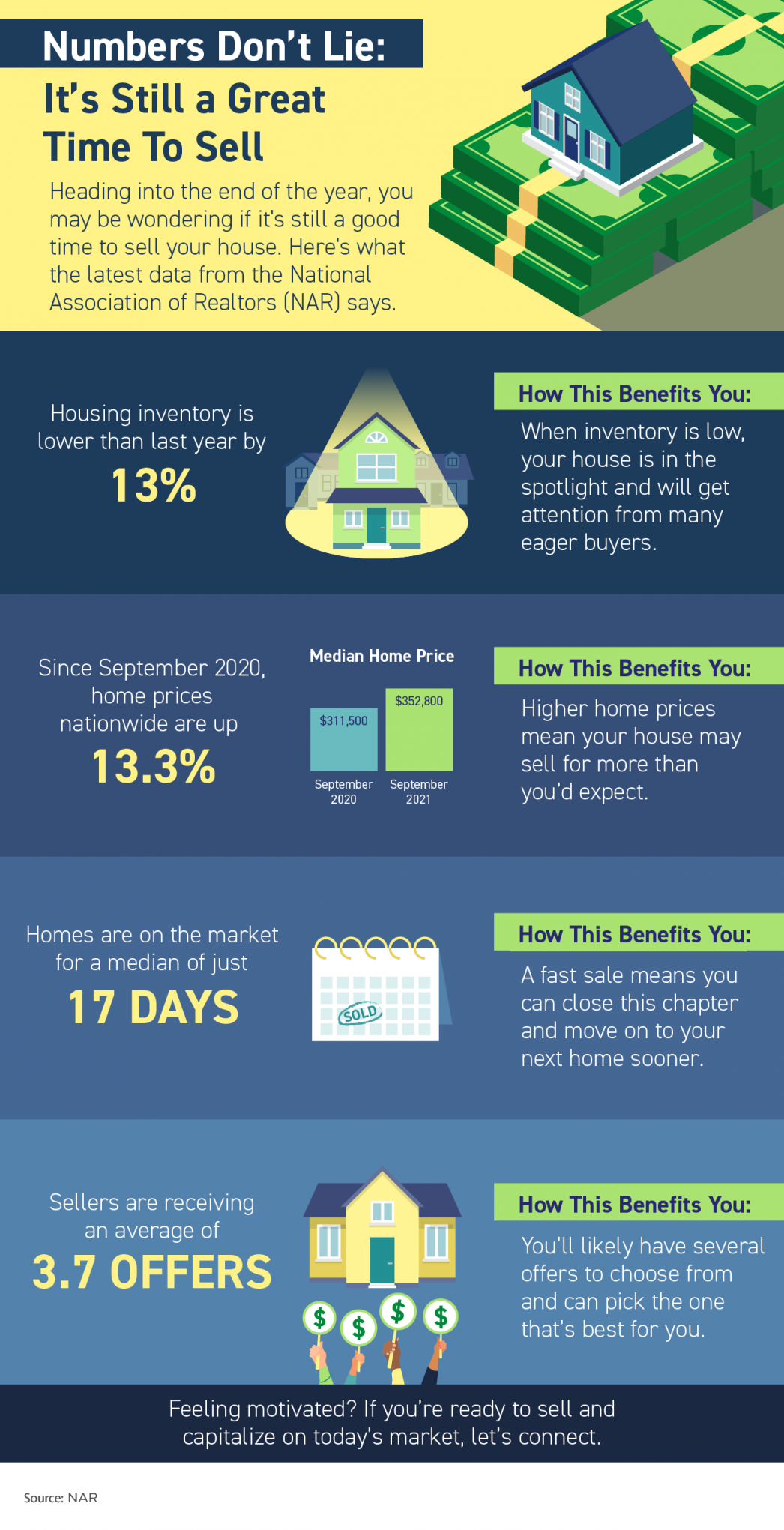

Sellers Have Incredible Leverage in Today’s Market

With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying: "Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year." But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest Existing Home Sales Report from NAR: “From one year ago, the inventory of unsold homes decreased 13%. . . .” What Does This Mean for Sellers Today?With buyers eager to purchase but so few homes available, sellers who list their houses this fall have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you. If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process. Bottom LineToday’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling. Let’s connect today to discuss how much leverage you have as a seller in today’s market.

0 Comments

Why a Wave of Foreclosures Is Not on the Way

With forbearance plans coming to an end, many are concerned the housing market will experience a wave of foreclosures similar to what happened after the housing bubble 15 years ago. Here are a few reasons why that won’t happen. There are fewer homeowners in trouble this timeAfter the last housing crash, about 9.3 million households lost their homes to a foreclosure, short sale, or because they simply gave it back to the bank. As stay-at-home orders were issued early last year, the fear was the pandemic would impact the housing industry in a similar way. Many projected up to 30% of all mortgage holders would enter the forbearance program. In reality, only 8.5% actually did, and that number is now down to 2.2%. As of last Friday, the total number of mortgages still in forbearance stood at 1,221,000. That’s far fewer than the 9.3 million households that lost their homes just over a decade ago. Most of the mortgages in forbearance have enough equity to sell their homesDue to rapidly rising home prices over the last two years, of the 1.22 million homeowners currently in forbearance, 93% have at least 10% equity in their homes. This 10% equity is important because it enables homeowners to sell their homes and pay the related expenses instead of facing the hit on their credit that a foreclosure or short sale would create. The remaining 7% might not have the option to sell, but if the entire 7% of those 1.22 million homes went into foreclosure, that would total about 85,400 mortgages. To give that number context, here are the annual foreclosure numbers for the three years leading up to the pandemic:

The current market can absorb listings coming to the marketWhen foreclosures hit the market back in 2008, there was an oversupply of houses for sale. It’s exactly the opposite today. In 2008, there was over a nine-month supply of listings on the market. Today, that number is less than a three-month supply. Here’s a graph showing the difference between the two markets. Bottom LineThe data indicates why Ivy Zelman, founder of the major housing market analytical firm Zelman and Associates, was on point when she stated: “The likelihood of us having a foreclosure crisis again is about zero percent.”

Experts Project Mortgage Rates Will Continue To Rise in 2022 Experts Project Mortgage Rates Will Continue To Rise in 2022 | MyKCM Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they’ve hovered in the historic-low territory. But even over the past few weeks, rates have started to rise. This past week, the average 30-year fixed rate was 3.14%. What does this mean if you’re thinking about making a move? Waiting until next year will cost you more in the long run. Here’s a look at what several experts project for mortgage rates going into 2022. Freddie Mac: “The average 30-year fixed-rate mortgage (FRM) is expected to be 3.0 percent in 2021 and 3.5 percent in 2022.” Doug Duncan, Senior VP & Chief Economist, Fannie Mae: “Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability.” First American: “Consensus forecasts predict that mortgage rates will hit 3.2 percent by the end of the year, and 3.7 percent by the end of 2022.” If rates rise even a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the reality is, as prices and mortgage rates rise, it will cost more to purchase a home. As you can see from the quotes above, industry experts project rates will rise in the months ahead. Here’s a table that compares other expert views and gives an average of those projections:Experts Project Mortgage Rates Will Continue To Rise in 2022 | MyKCMWhether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s homebuying affordability. That could be just the game-changer you need to achieve your homeownership goals. Bottom Line If you’re thinking of buying or selling over the next year, it may be wise to make your move sooner rather than later – before mortgage rates climb higher.

|

Let's ConnectWith the correct person by your side, the buying and selling process doesn't have to be full of stress, doubt and anxiety - it can actually be FUN! Archives

July 2024

Categories

All

Jacquelyn Duke, Realtor®

Licensed to Sell in the State of Iowa [email protected] (515) 240-7483 Realty One Group Impact 617 SW 3rd Street Ste 101 Ankeny, IA 50023 Disclaimer: The material on this site is solely for informational purposes. No warranties or representations have been made. |

RSS Feed

RSS Feed